Understanding a marriage contract Ontario helps you secure your finances about your marriage.

Understanding a marriage contract Ontario helps you secure your finances about your marriage.

Blog Article

Key Factors You Should Required a Prenup Contract Prior To Going Into a Marriage Agreement

Understanding the Fundamentals of a Prenuptial Contract

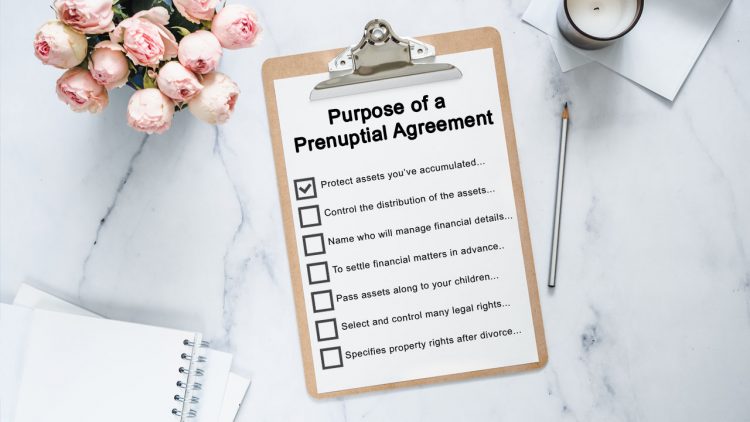

While numerous perceive it as unromantic, a prenuptial arrangement, or 'prenup', serves as a sensible device in the world of marriage planning. This lawfully binding contract, usually structured by spouses-to-be, describes the department and circulation of assets and responsibilities in the event of separation or death. It is essential to understand that prenups aren't just for the wealthy. Rather, they give a clear economic roadmap for couples, cultivating open communication concerning monetary issues and possibly avoiding disputes down the line. In spite of its somewhat downhearted property, a prenuptial contract can considerably alleviate the stress and anxiety and unpredictability that usually come with divorce procedures, providing a sense of protection and control to both celebrations entailed.

Safeguarding Individual Properties and Financial Obligations

To safeguard individual assets and debts in a marriage, a prenuptial contract proves to be a vital tool. Furthermore, a prenuptial arrangement is crucial in safeguarding one from the other's financial debts. Therefore, a prenuptial agreement offers a safety net, making sure economic ramifications of a potential breakup do not unjustly downside either party.

Defense for Service Proprietors

For many entrepreneur, a prenuptial contract can be a vital safety procedure. It safeguards businesses from being divided or marketed in the event of a separation. Whether it's a growing business or an appealing start-up, the see page proprietor's share remains intact. This security expands beyond the owner to companions and shareholders, stopping interruption in business procedures. Also if one partner spent in the business throughout marital relationship, a well-crafted prenup can identify that business isn't thought about marriage building. It also guarantees that the non-owner partner is relatively made up without jeopardizing the service's security. A prenuptial agreement is not just an agreement in between future spouses; it can be seen as an insurance coverage policy for the service.

How Prenups Protect Future Inheritance and Estate Plans

In the world of future inheritance Going Here and estate plans, prenuptial contracts serve as an essential protect. These arrangements can explicitly specify that certain possessions, like an inheritance, should not be classified as marriage home. Hence, prenuptial arrangements play an essential duty in preserving future wealth and making certain an individual's monetary stability (Flat fee prenuptial agreement).

Making Certain Family Assets and Interests

While prenuptial agreements are usually watched as a method to secure specific riches, they likewise offer an essential duty in making sure family members properties and passions. Thus, the addition of a prenuptial arrangement in a marriage contract can offer as a safety shield, preserving the integrity and safety of household assets and rate of interests for future generations.

The Role of a Prenup in Clarifying Financial Obligations

Beyond protecting family members assets, prenuptial contracts play a crucial role in marking financial responsibilities within a marriage. In the unfavorable occasion of separation, a prenup can avoid bitter wrangling over debts and possessions, as it plainly demarcates what belongs to whom. Therefore, by clearing up monetary responsibilities, a prenuptial agreement promotes openness and depend on, two keystones of a solid marital relationship.

Conclusion

In conclusion, a prenuptial arrangement works as a safety shield for private properties, business interests, and future inheritances prior to going into a marriage agreement. It develops a clear economic environment, decreasing potential disputes and safeguarding family wealth for future generations. In addition, it plays an important useful reference duty in marking financial duties, advertising healthy communication, and making sure security even when encountered with unanticipated circumstances.

Report this page